New Jersey Continues its Push to End the Misclassification of Employees as Independent Contractors

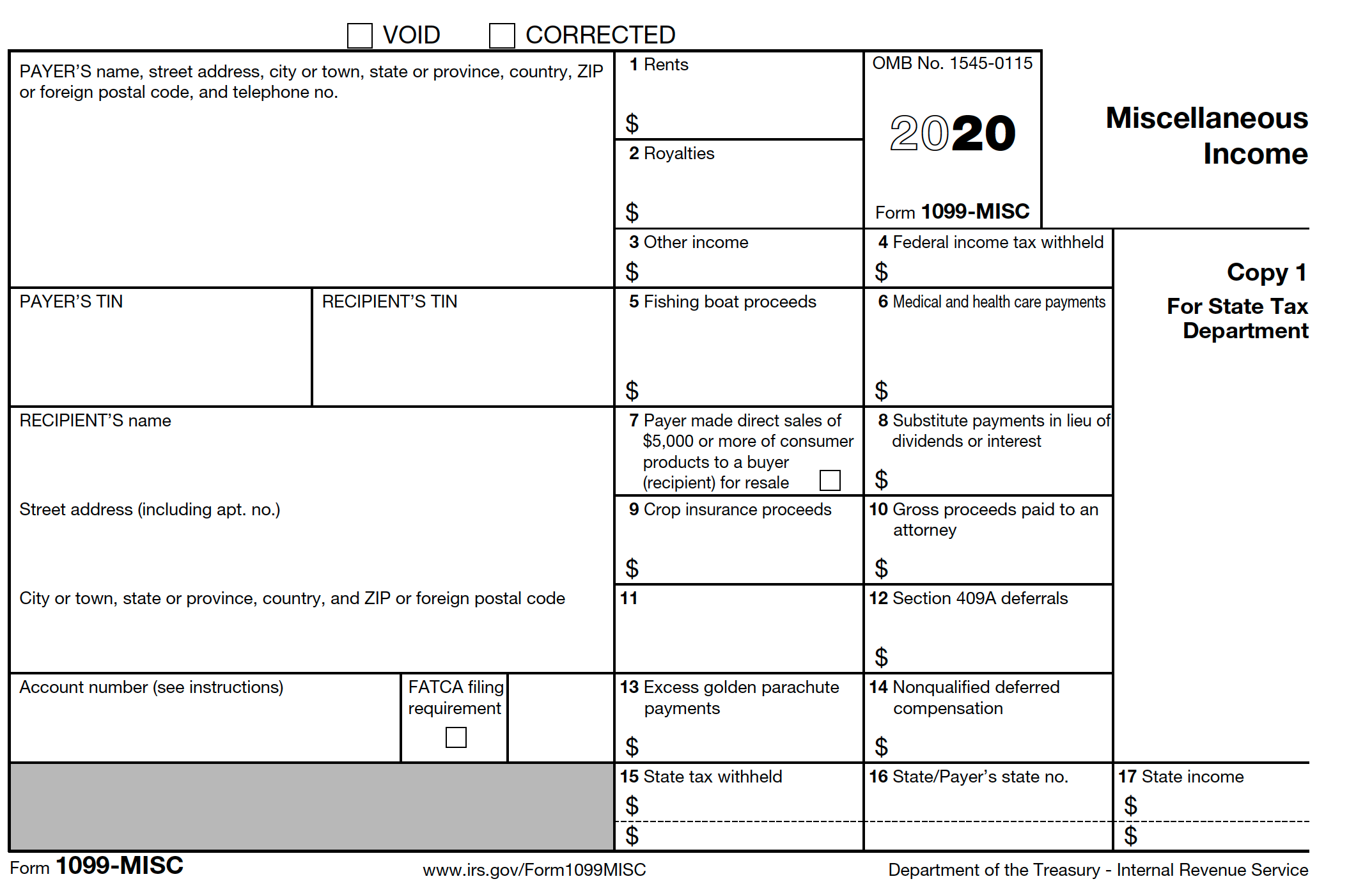

Form 1099

As we previously posted, under Governor Murphy’s administration, New Jersey has actively sought to end the misclassification of employees as independent contractors. On January 20, 2020, New Jersey enacted five new laws, called the “Misclassification Package,” that substantially increase the New Jersey Department of Labor’s (NJDOL) enforcement powers in misclassification matters.

These new laws are particularly significant to any business that utilizes independent contractors due to New Jersey’s broad definition of “employee.” Under New Jersey law, a worker is an employee for purposes of the state’s employment, benefit, and tax laws, unless the employer can show that:

(A) Such individual has and will continue to be free from control or direction in the performance of such service, both under his contract of service and in fact; and

(B) Such service is either outside the usual course of the business for which such service is performed or that such service is performed outside of all of the places of business of the enterprise for which such service is performed; and

(C) Such individual is customarily engaged in an independently established trade, occupation, profession, or business.

The above test is known as the “ABC test” and is codified at N.J.S.A. 43:21-19(i)(6). The ABC test provides for a much broader definition of employee then is found under federal law. Thus, businesses in New Jersey could be faced with a situation where an independent contractor is properly classified under federal law, but such individual is an employee under New Jersey law.

Below is a summary of the Misclassification Package:

Increased Penalties (A5839)

Effective immediately, the Commissioner of Labor is authorized to assess an “administrative misclassification penalty” of up to $250 per misclassified employee for a first violation and up to $1,000 per misclassified employee for each subsequent violation. Additionally, the Commissioner can impose a fine of “no more than 5% of the worker’s gross earnings over the past 12 months.” These fines and penalties are in addition to any penalties provided for under any other statutes and can be assessed upon a finding of misclassification under any state wage, benefit, or tax law.

Stop-Work Orders (A5838)

Effective immediately, the Commissioner is authorized to issue stop work orders against any employer determined to be in violation of any state, wage, benefit, or tax law. Stop-work orders are effective on seven days’ notice and generally remain in effect until the Commissioner issues an order releasing the stop-work order, after the employer agrees to pay, and actually pays, the required wages and penalties. The law imposes a $5,000 per day civil penalty for each day that an employer conducts business operations in violation of a stop-work order.

Joint and Several and Individual Liability (A5840)

Effective immediately, client employers and labor contractors are jointly and severally liable for violations of state employer taxes. Additionally, the law imposes personal liability upon “any person acting on behalf of an employer, including a client employer or labor contractor” who violates any state wage and hour or tax law.

Information Sharing (S4228)

Effective immediately, the New Jersey Division of Taxation is authorized to share with the Department of Labor, any information, including tax information statements, audit files, or investigation reports.

Posting Requirements and Cause Retaliation (A5843)

The final law of the Misclassification Package becomes effective on April 1, 2020, and requires employers to post a detailed notice concerning employee misclassification, explaining:

The bar on employers’ misclassifying workers as independent contractors;

The state definition of an employee (i.e. the “ABC” test);

Benefits and rights of employees under state law;

New Jersey’s remedies for workers who are misclassified; and

Contact information to report misclassification complaints.

This law also creates cause of action for unlawful retaliation, with damages matching those under the Wage Theft Act.

Given the significant powers granted to the Commissioner to combat employee misclassification, New Jersey’s broad definition of employee, and the significant liabilities arising from employee misclassification, businesses should be extremely cautious in utilizing independent contractors.

If you have any questions about the classification of your business’s workers, please contact us at (201) 345-5412 or through our online scheduling calendar to set up a complimentary consultation.